We’re doing a bit of a topic pivot this week and focusing in on finances. Don’t worry, it’s not as daunting as you may think. We talk all things wellness here at Living & Lifestyle. But we also focus in on productivity, self care and living your best life. It’s important to acknowledge, whether we like it or not, finances play a big role in our lives. Your financial health can often be directly connected to your overall well-being.

Money can cause a lot of stress, it sucks. So instead of hiding from it, let’s try to find ways to set yourself up for success and knock your financial goals out of the water! We’ll all be able to breath a bit lighter when we know our financial goals are taken of.

So let’s break down 5 steps you can take, to set and achieve your financial goals as we close out this year. And hey, hopefully this will help set you up for success, as we move into a new year in a few short months.

Assess Your Finances: Where Are You At? Where Would You Like To Go?

The first step to building out goals and an action plan is to first take a look at where you’re at with your finances. How much comes in every month? How much goes out? If those two numbers aren’t balanced, we have a problem.

First look at all the money coming in. Perhaps you work a salary job and you get paid the same amount every month. You may work a couple of different jobs, or you’re a freelancer, your pay cheques may vary. Just start with month one, track every bit of money that comes in. Even gifts! You want to get a sense of the total income.

Then you need to start taking note of what you’re spending. Start fresh on a new month and begin to track everything that goes out. For example, I personally like to try to pay for things with my debit card (this makes it easier to see every purchase that is going out as the month goes on.) I used to use my credit cards a lot more, and honestly it just got me into trouble. I would over spend, it was a lot harder to keep within my means every month. So now, when I do put certain purchases on my credit card (so I want to get the points for a larger purchase), I aim to pay it off right away and it comes out of that month’s spending budget.

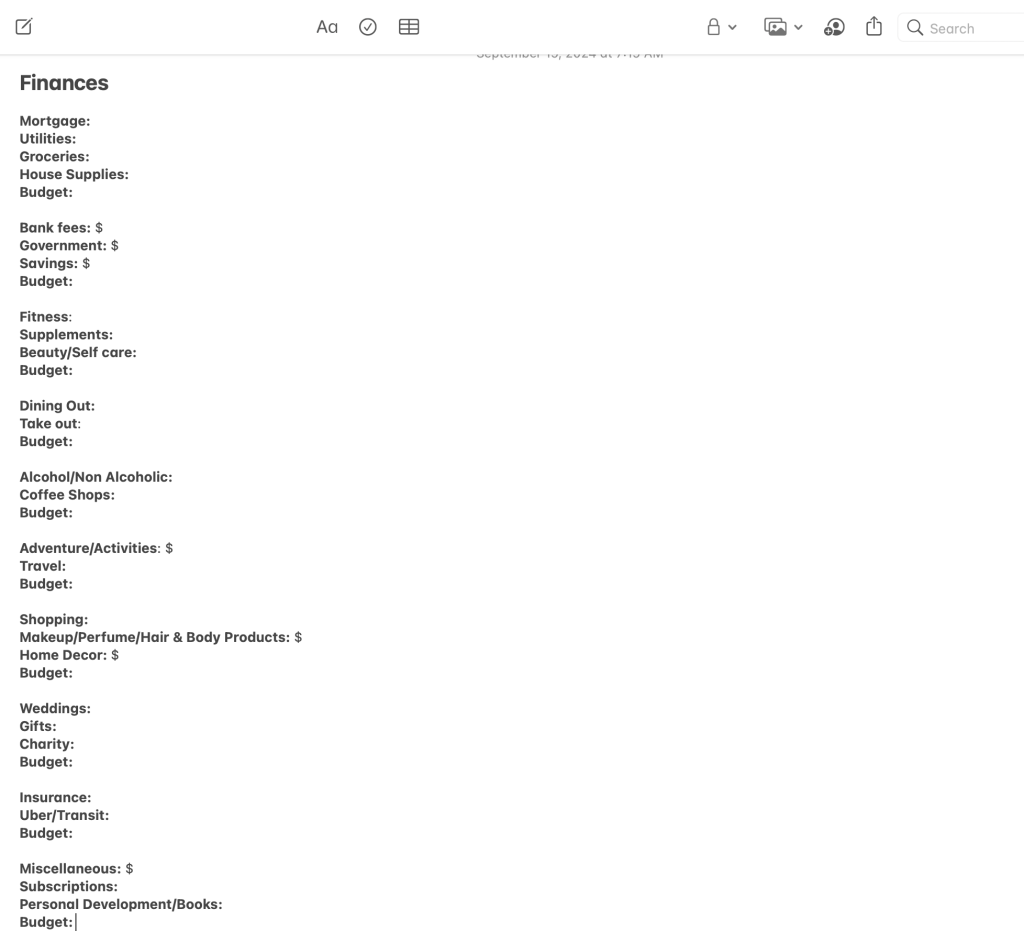

Break your expenses into categories. This will be dependant on your lifestyle, but a good place to start is living expenses. Note your mortgage or rent, your phone bill, utilities, car payments, gas, insurance, groceries etc. Things you have to pay every month. Then you can have a category for more of the variable expenses, it’s up to you how specific you want to get. I personally have categories for coffee shops, dining out, take out, fitness, supplements, beauty appointments. I am pretty thorough on my different categories. But it’s totally up to you, in terms of how detailed you want to be.

Remember if you’re going to be using cash, write it down right away, as soon as you spend the money, make a note. Otherwise you may forget. I personally like to keep my categories in my “notes app”, just so I have easy access to it on a daily basis. Every week I will go through my bank statement and update my spending from that week, then at the end of the month, I tally it up and put it into an excel doc, that’s personally the way I like to track. But more on that later!

This first step is to get a sense of your overall picture. Once you’ve done a month of tracking, you can see your financial situation a lot clearer, and then you can decide your goals and where you want to go next.

Create A Realistic Budget

In order to get yourself into a place with your finances that you’re happy with, you’ll want to create a budget. Similar to what I said above, note all of your income and all of your expenses. Once you’ve seen it after month one, you have a better idea of what sort of budget you can create. I personally don’t follow my budget to an exact, I just have an idea of where my numbers should be at every month.

For example, my household expenses are typically the same every month. Let’s say I allocate $2,000 to my mortgage every month, $500 to groceries, $50 to my phone bill, $150 to gas and $150 to insurance. Then I know I have to have $2,850 available every month for those fixed expenses. That’s just an example. Oh anf if you want to be saving, which is the goal, you should add that amount into the fixed expenses as well. So let’s say I want to save $150 a month, that brings my fixed expenses up to $3,000 every month. How much is left over for more of the frivolous/wants spending?

I like to set a budget for my shopping, my meals out of the house, my self care, just to keep myself on track. I do sometimes go over or under on these numbers, but at least I have a ball park. Some people follow their budget to an exact and that’s amazing! I just don’t have a rigid enough lifestyle for this haha.

Create A Dream Budget

This one is more for fun. I read somewhere once, that if you want to envision where you want to go, you have to have an idea of what that looks like. So make a dream budget! What does your dream life look like? This one was super fun for me haha because honestly, my goal is to make a lot of money.

How much will you need for your fixed expenses? Maybe you want a nicer car, or you want to have a family one day, or you want to buy a second property. Put it in the dream budget. Refer back to it once in a while as a reminder to what you’re working towards. If your dream budget is to spend and save the equivalent of $7,000 every month, then you need to figure out how you’re going to earn that much. It’s going to take some goal setting and execution.

Track Your Spending

This point is very similar to point number one where I go over fixed vs. variable expenses. I’ll share with you below, how I track my spending in notes and what software I use. I’ll also link a few different budget setups you can use. It’s really just going to depend on the style you like best!

We personally just use an excel document from Google. I think we found it as a template years ago and then we just tailored it to our needs. You can also browse a variety of budget trackers on Etsy, linked here. We also really like the financial creator, Chelsea Pursuit. She has a really awesome template we’re likely going to switch to next year!

And so, as I mentioned in the first point of the blog. I track my spending on a weekly basis in a notes app that looks like this photo below. And then at the end of the month, I typically spend an hour or so adding up my spending and transferring my totals to the excel doc. I could edit the excel doc every week, but I find it easier to track where I left off, when I have it written out clearly in my notes. It’s all going to be personal preference!

Continue To Check In With Your Spending And Your Goals On A Quarterly Basis.

It’s important to remember when setting goals, that you need to be checking in with those goals and the progress you’re making overtime. It’s the same with your finances. If you’re not tracking your progress or keeping an eye on how your financial planning is going, it’s going to be more difficult to measure if you’re on the right track. Perhaps you take a look every quarter, that’s personally what I like to do. We’re about to enter Q4, you can start now or wait until the new year, do what feels best for you.

We hope that this blog has been helpful for you to learn the task of financial goal setting and planning for your future. Financial health isn’t an easy task for anyone. It takes practice, focus and consistency. But once you get the hang of it, you’ll love it. I couldn’t go back to not knowing where my money was going. It’s almost like a fun game every month, how much money can I save? How much less can I spend? It’s a good exercise!

If you enjoy personal development, check out our blog on How to Get Your Life Together. It’s a great one to read as we head into a new quarter. And let us know what sort of budgeting you like to do, if you’ve tried it before. We’re here to learn and grow alongside you.

Until next time,

xo

Cornelia & Meg